Quick PayPal Cash: A Comprehensive Guide

Are you looking for a fast and convenient way to manage your finances? Look no further than Quick PayPal Cash. In this detailed guide, we’ll explore the ins and outs of this popular service, covering everything from how it works to its benefits and limitations.

How Quick PayPal Cash Works

Quick PayPal Cash is a service offered by PayPal, one of the world’s leading online payment platforms. It allows users to access their PayPal balance quickly and easily, either through a linked bank account or a PayPal Cash Card.

Here’s a step-by-step breakdown of how Quick PayPal Cash works:

-

Create a PayPal account if you don’t already have one.

-

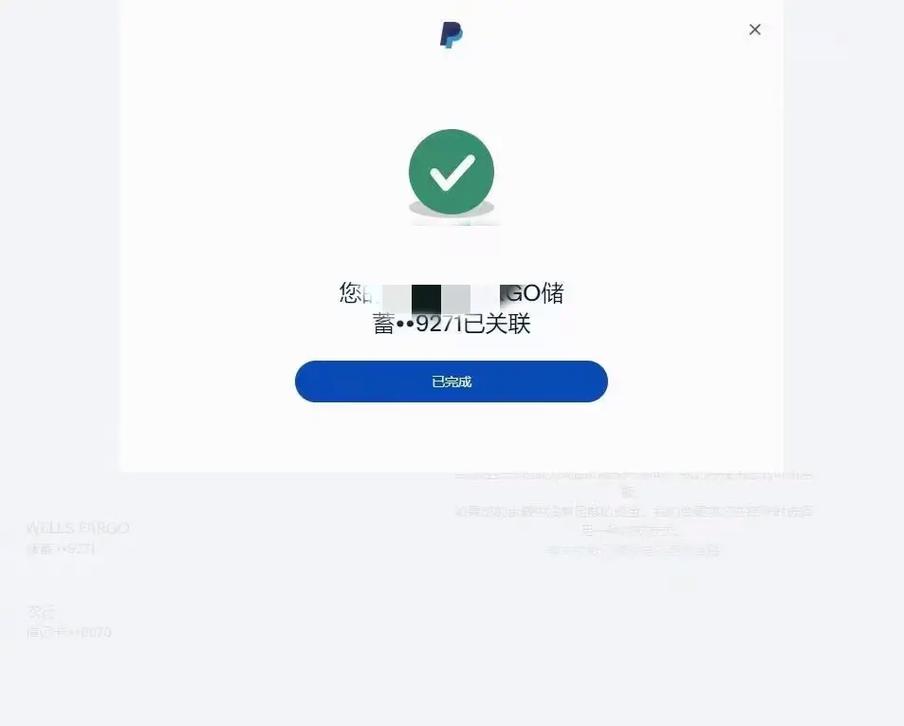

Link your bank account or credit/debit card to your PayPal account.

-

Transfer funds from your bank account or credit/debit card to your PayPal balance.

-

Use your PayPal balance to make purchases, send money to friends and family, or withdraw cash at participating retailers.

Benefits of Quick PayPal Cash

Quick PayPal Cash offers several advantages over traditional banking methods, making it a popular choice for many users. Here are some of the key benefits:

-

Convenience: Access your PayPal balance anytime, anywhere, with just a few clicks.

-

Security: PayPal uses advanced encryption and security measures to protect your financial information.

-

Speed: Transfers to your PayPal balance are typically instant, allowing you to manage your finances quickly and efficiently.

-

Flexibility: Use your PayPal balance for a variety of purposes, including online shopping, bill payments, and person-to-person transfers.

Using the PayPal Cash Card

One of the most convenient ways to access your Quick PayPal Cash is through the PayPal Cash Card. This reloadable card can be used anywhere Visa is accepted, making it easy to manage your finances on the go.

Here’s how to use the PayPal Cash Card:

-

Apply for a PayPal Cash Card by visiting the PayPal website or app.

-

Activate your card and link it to your PayPal account.

-

Load funds onto your card from your PayPal balance or bank account.

-

Use your card to make purchases, withdraw cash at ATMs, or pay bills.

Understanding Fees

While Quick PayPal Cash offers many benefits, it’s important to be aware of the fees associated with the service. Here’s a breakdown of some common fees:

| Fee Type | Description |

|---|---|

| Transfer Fee | Varies depending on the method of transfer (e.g., bank account, credit/debit card) |

| Withdrawal Fee | May apply when withdrawing cash from an ATM or participating retailer |

| Foreign Transaction Fee | May apply when making purchases in a foreign currency |

Is Quick PayPal Cash Right for You?

Quick PayPal Cash can be a great option for many users, but it’s important to consider your individual needs and financial goals before deciding to use the service. Here are some factors to consider:

-

Convenience: If you’re looking for a fast and easy way to manage your finances, Quick PayPal Cash may be a good fit.

-

Security: PayPal is known for its strong security measures, but it’s always important to keep your account information safe.

-

Fees: Be aware of the fees associated with Quick PayPal Cash to ensure it fits within your budget.

-

Usage: Consider how you plan to use the service and whether it aligns with your financial goals.

By understanding how Quick PayPal Cash works, its benefits, and limitations, you can make an informed decision about whether it’s the right service for you